What gets measured gets improved—and when it comes to finances, this is especially true. Having a thorough understanding of your financial health is essential to making the right decisions, and none of it would be possible without sound bookkeeping.

At the heart of this process are journal entries in accounting, which serve as the fundamental building blocks to record your organization’s transactions.

What Is a Journal Entry in Accounting?

A journal entry in accounting is a detailed account of a financial transaction recorded in your general ledger, making it the cornerstone of healthy and effective record-keeping.

In accounting, journal entries serve as a systematic way of keeping track of an organization’s finances, ensuring compliance and accuracy in bookkeeping.

What Is Recorded in a Journal Entry in Accounting?

When recording a journal entry in accounting, bookkeepers typically include detailed information about each transaction including:

- Date of transaction

- Debit and credit amounts

- Type of transaction (E.g. Deposit, payment)

- Accounts involved

- Notes or a description

Journal Entry Debits and Credits

A journal entry in accounting can be recorded as either a debit or a credit. Debits and credits are used to record changes in assets, liabilities, equity, revenue, and expenses.

For example, debit entries decrease liabilities and equity for certain types of accounts, like asset or expense accounts, while credits increase liabilities, equity, and revenue.

Types of Journal Entries in Accounting

There are various types of journal entries in accounting, each with different purposes.

-

Simple Journal Entry

A simple journal entry is the simplest way of recording an accounting record and it does so by recording a single transaction which can be either a credit or a debit.

Simple Journal Entry Example

If your organization pays $100 for a purchase of office supplies a simple journal entry would be recorded in your general ledger showing:

An expense for office supplies of $100 in the debit column and a credit of $100 in cash in the credit column.

-

Reversing Journal Entry

A reverse entry in accounting is typically seen as an optional record. One that’s usually performed at the beginning of an accounting period to adjust or “reverse” certain entries to simplify future transactions.

Reverse Journal Entry Example

If your organization accrued $10,000 in employee wages at the end of the previous accounting period, a reverse journal entry would be recorded in your general ledger as follows:

A debit to wages expense of $10,000 and a credit to wages payable of $10,000.

-

Compound Journal Entry

Compound journal entries in accounting occur when a transaction involves two or more accounts. This typically happens when a single transaction has multiple debits, credits, or a combination of both.

Compound Journal Entry Example

Let’s say your organization purchases $2,000 worth of office furniture, then pays $500 in cash and finances the rest of the purchase by taking out a $1,500 credit. In this case, a compound journal entry would be recorded in your general ledger showing:

A debit to office furniture of $2,000 in the debit column, a credit to cash of $500 in the credit column, and a credit to accounts payable of $1,500 in the credit column.

-

Closing Journal Entry

To illustrate this, let’s say your organization closes its revenue and expense accounts at the end of an accounting period with $10,000 in revenue and $7,000 in expenses. In that case, a closing journal entry would be recorded in your general ledger showing:

Closing Journal Entry Example

To illustrate this, let’s say your organization closes its revenue and expense accounts at the end of an accounting period with $10,000 in revenue and $7,000 in expenses. In that case, a closing journal entry would be recorded in your general ledger showing:

A debit to revenue of $10,000 in the debit column and a credit to retained earnings of $10,000 in the credit column.

A debit to retained earnings of $7,000 in the debit column and a credit to expenses of $7,000 in the credit column.

-

Adjusting Journal Entry

Much like closing journal entries, an adjusting journal entry in accounting is given by its name. These journal entries serve the purpose of recording transactions that haven’t been included in the balance.

Adjusting Journal Entry Example

As an example, let’s say your organization owns machinery that gets depreciated over time, and the description for the last month amounts to a total of $1,200 which was not previously recorded in your books. In such a case, an adjusted journal entry can be recorded in your general ledger showing:

A debit-to-depreciation expense of $1,200 in the debit column and a credit-to-accumulated depreciation of $1,200 in the credit column.

Tracking Journal Entries With ERP

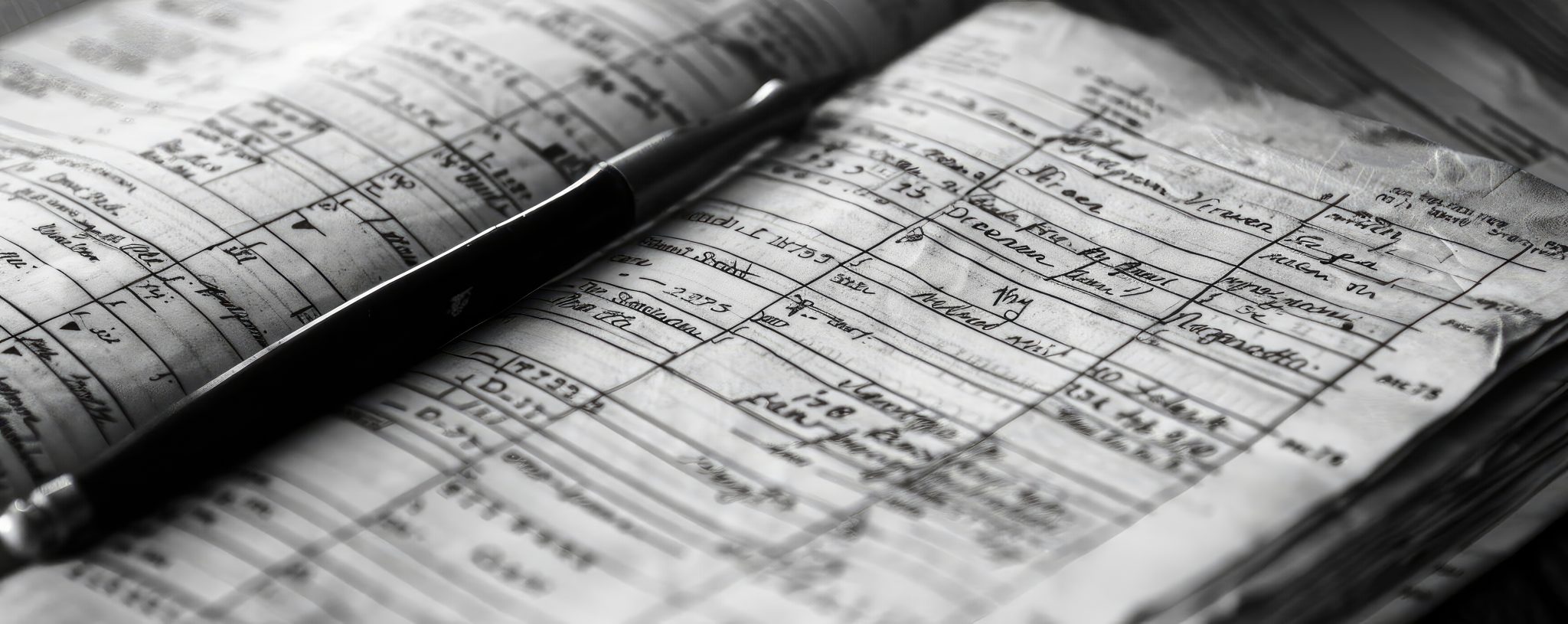

In the past, journal entries in accounting were performed manually, in physical books or spreadsheet software which made the process time-consuming and prone to errors. These errors are typically aggravated as organizations expand and outgrow the capabilities of manual labor.

However, accounting teams are no longer restrained by the limitations of manual accounting. Instead, general ledger accounting software like XLedger simplifies the process by offering a robust core accounting engine and a cloud finance management system.

As a leading ERP online system in the United States, XLedger is designed to help accounting teams automate the journal entry process, eliminating the need for bolt-on and reconciliation conflicts. Our ERP software delivers fast, accurate, compliant, and cost-effective results for modern finance teams and busy CFOs.

Take a product tour today to discover how XLedger can transform your business.

Curious About What Else ERP Software Can Do For Your Accounting?

Check out these value-packed resources:

- What is General Ledger Accounting Software?

- What Is Enterprise Value (EV)? And How it Is Calculated

- How Finance Automation Tools Help Staff Add Value