10/24/2024

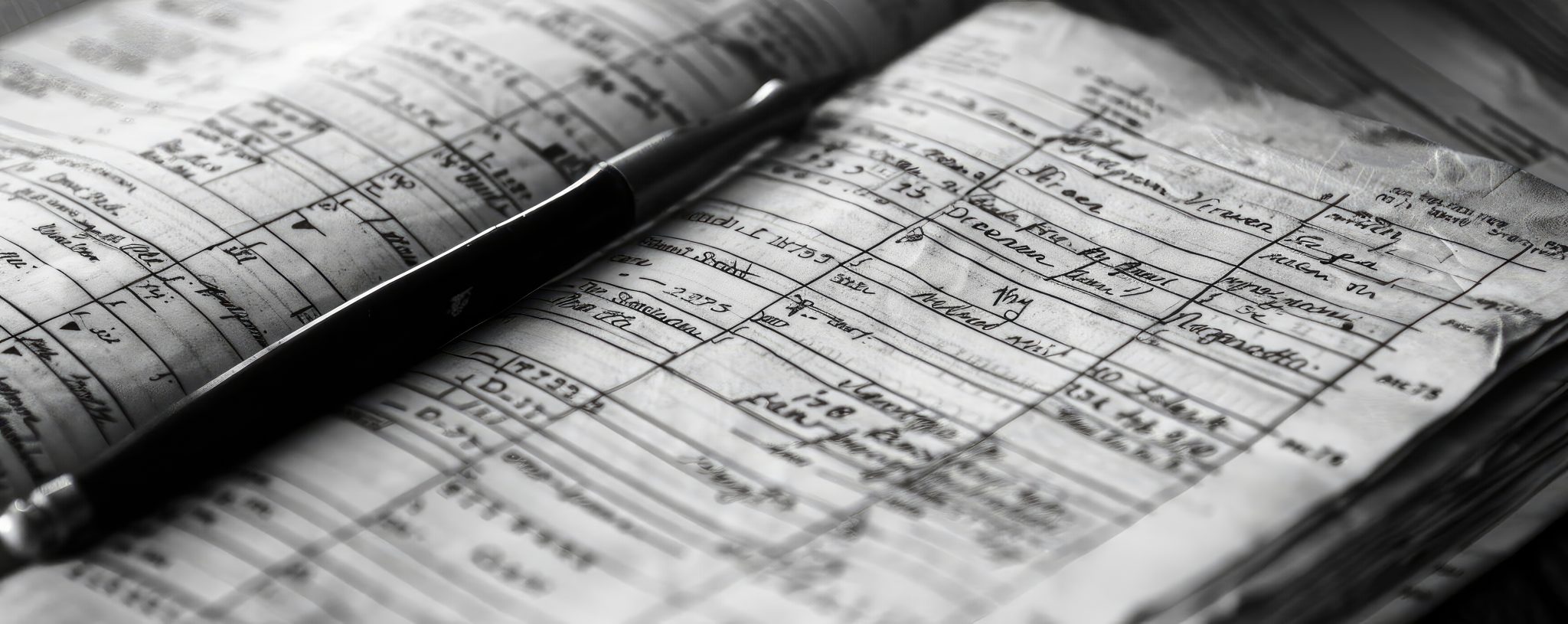

What Is Procurement? A Comprehensive Guide

As organizations scale, it quickly becomes evident how critical it is to have strong processes in place that ensure healthy financial practices and standardization across the organization. Without proper standard procedures in place, particularly on the financial side, organizations can quickly spiral out of control which can lead to serious problems. At the core of […]