Blogs

Accounts Payable vs Accounts Receivable: How Are They Different?

It’s Friday afternoon, and you’re ready to leave the office. But a pending invoice issue can’t wait until next week. You call the supplier and spend the next 30 minutes reasoning with an automated phone system to reach the right department. After a long wait, you finally get through to a real person.

The problem?

You’ve confused the accounts payable with the accounts receivable department—again.

This means you will have to wait longer and hope the person in charge is still at their desk when you connect with them.

Does this scenario sound familiar?

This predicament is not unusual; perhaps something similar has happened to you or someone you know. Managing cash flow involves both the accounts payable and accounts receivable departments, which can make it easy to mix up both.

To address the issue, we assembled our accounting experts to create this thorough guide. Here, you’ll discover the differences between the two concepts. You’ll learn easy tips to help you remember, and discover how accounts payable workflow software can help your organization automate processes.

What Is Accounts Payable (AP)?

Accounts payable (AP) refers to the amount a business owes to a third party for goods or services received but not paid for. In other words, it’s an unpaid invoice from a contractor or supplier.

Business-to-business transactions typically allow for a repayment grace period known as a payment term. Payment terms can vary from vendor to vendor but they typically range between net-10 and net-90. This means businesses allow customers between 10 and 90 days to pay the bill without penalty.

Since accounts payable represent money your organization owes, they are considered liabilities and recorded as such on your organization’s balance sheet.

Once an invoice is received and approved, the line item needs to be added to your online ERP system which increases your balance sheet’s total liabilities.

Example of an Accounts Payable Transaction

Let’s assume your organization orders $1000 of office supplies from The Office Superstore on January 11.

The Office Superstore would then send your organization the supplies and an invoice stating payment is due within 30 days (net 30). At this point, your bookkeeper would create an accounts payable journal entry to increase your balance sheet’s total liabilities by $1000.

Once the invoice is reviewed and approved, your organization will process the payment of $1,000 for the supplier on (or before) the due date—February 10.

After the payment is complete, the transaction must be closed on your ledger. When it does, the liability will be settled.

The Accounts Payable Process

Here are the key steps in the accounts payable process:

- Create a purchase order (PO).

- Receive the goods or services.

- Receive and register the supplier’s invoice.

- Match the PO with the goods receipt note (GRN) and invoice to verify accuracy.

- Authorize and process the payment.

The process can be strenuous and consume valuable time and resources when performed manually. This is why so many organizations turn to accounts payable workflow software to help them streamline their accounting.

Learn how to take control of your accounting processes with cloud accounts receivable and accounts payable software here.

What Are Accounts Receivable (AR)?

Accounts receivable (AR) refers to the amount of money a business is owed for goods or services by a customer. Since accounts receivable represent what others owe you, they’re registered as an asset on your balance sheet.

You are now positioned on the opposite side of the accounts payable transaction. Therefore, payment terms apply to accounts receivable like they do to accounts payable. If your organization prepares a net-60 invoice, your customers will enjoy a penalty-free 60-day period to pay for your goods or services.

Once payment is collected, the item line is converted into cash, increasing your balance sheet’s cash position.

Example of an Accounts Receivable Transaction

Say you work for a marketing firm and completed a $5,000 project on March 11 for a non-profit called Save The Forest.

Upon completion, your marketing firm will create and issue an invoice for the total amount with a net 30-day payment term. At this point, your bookkeeper will record a sales transaction by creating an accounts receivable journal entry in your ledger. As a result, an additional $5,000 will be added to your balance sheet’s total assets.

If the payment is not received within the grace period, your accounts receivable department must issue a reminder for your customer. However, Save The Forest is a well-organized non-profit that uses finance automation software to stay on top of their finances and pay vendors on time. So, the payment is settled within the 30-day grace period.

Once the non-profit pays your firm, your bookkeeper will record another journal entry that decreases (credits) accounts receivable by $5,000 and increases (debits) your bank balance by $5,000.

The Accounts Receivable Process

Here are the critical steps in the accounts receivable process:

- Create and send an invoice after the goods or services are delivered to the client

- Track the invoice status

- Send the client a reminder if it’s not paid on time

- Record the payment in your ledger once the correct amount is received

Streamline your accounting processes using online ERP software here.

How Are Accounts Payable and Accounts Receivable Different?

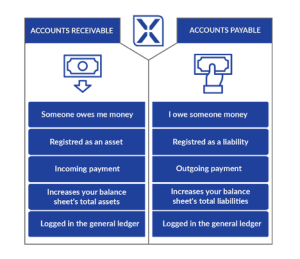

Accounts receivable and accounts payable are two sides of the same coin. They’re different, but they share some similarities.

For example, both are integral components of the accounting cycle, involve transactions, and impact your organization’s cash flow. Yet, they deal with opposite sides of the transaction. One receives, and the other pays.

We know it can be difficult to remember. That’s why we created this downloadable graphic that you can keep on your computer desktop or print by your desk to help you remember which one is which.

Tips To Help You Remember

One of the most common reasons professionals confuse accounts receivable with accounts payable is that you could be on either side of the transaction, depending on whether money is coming in or paid out. This mirroring dynamic in the accounting process can make it challenging to keep track of who’s in charge of what and who you need to get in contact with.

The most efficient way to remember and distinguish one from the other is by dissecting the department’s terminology.

For example, accounts payable is always the department that pays a third party. That’s why it’s called accounts payable. On the other hand, accounts receivable is always the department that receives the payment. That’s why it’s called receive-able.

Easy enough, right? By remembering this simple tip, you can easily tell one from the other.

Using Finance Automation Software To Streamline Accounts Payable and Accounts Receivable

Tracking accounts payable and accounts receivable is key to understanding your company’s financial position. By using online ERP software that automates accounting processes, your business can reduce spending, manage cash flow effectively, and forecast for the future.

Leveraging a platform that streamlines your AP and AR process can free your CFO and bookkeepers from tedious tasks like data entry and invoice processing. This allows your accounting team to focus on strategic planning and reduce overhead.

At XLedger, we empower ambitious businesses to master their accounting cycle with cloud-based automated financial reporting software. Our ERP system fully and partially automates accounts receivable and accounts payable processes.

Free your finance team from tedious billing and payment tasks. Book a free one-on-one demo to learn how Xledger can help you automate your accounts receivable and accounts payable processes.