With CFOs increasingly expected to act as change leaders within their organisations, outsourcing finance functions could be critical to business growth.

Five key benefits to finance outsourcing for mid-market organisations

- Remove resourcing challenges from your agenda and put that time back into business strategy.

- Benefit from a range of competencies and expertise that can flex around your needs.

- Work with experts that already know your industry whilst enjoying the value of cross-industry experience from a wider team.

- Trust insights are grounded in your current business with real-time data.

- Get strategic support on market opportunities and business transformation – for now and into the future.

Talent shortage is holding back the financial sector

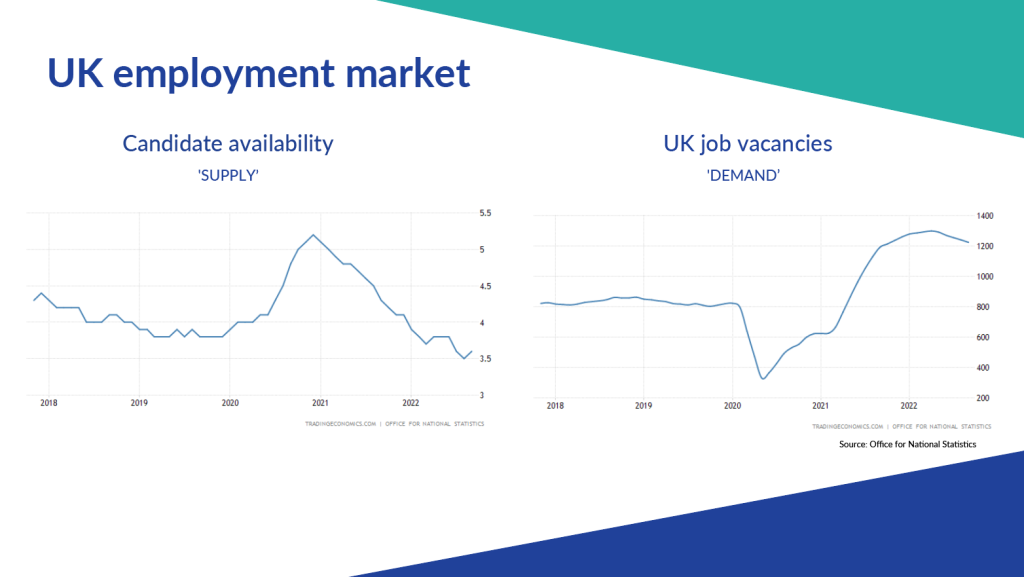

Insights gathered from our recruitment partner at Core3 (shown in figure 1 and 2 below) show that the finance and accounting talent market is currently a challenging factor when it comes to hiring the right calibre of skilled finance professionals at a pace that supports business ambition.

Figure 1

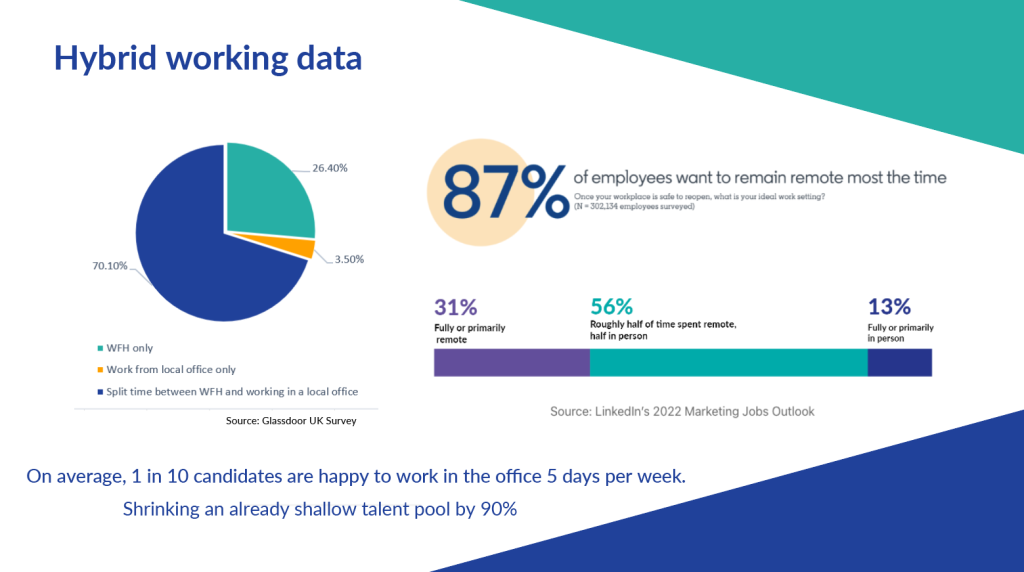

Figure 2

Figure 2

“The number of vacancies in the UK hit an all-time high in the summer of 2022, and we continue to be in a ‘war for talent’ where vacancy demand outweighs candidate supply. Since then, we have experienced an inevitable flattening of vacancy growth, but it is still 40% above pre-pandemic levels, despite the economic uncertainty ahead of us.” says Leo Hewett, Managing Director at Core3 Recruitment.

According to data published by the Institute of Chartered Accountants revealed a 36% decline in accountancy applicants year-on-year between June 2021 and June 2022. Factors such as the ongoing repercussions of the Covid-19 pandemic, people changing careers and experienced professionals opting for early retirement mean that finding skilled finance professionals is proving more and more difficult. Hewett to add: “On average, only 1 in 10 candidates are happy to work in the office 5 days per week, so if employers aren’t able to offer hybrid working, they are shrinking an already shallow talent pool by as much as 90%”.

What the Norwegian market has taught us

The Norwegian market is currently seven or eight years ahead of the UK when it comes to leveraging the benefit of cloud-based finance. What Xledger’s Scandinavian operations have shown over the past decade is that by removing the reliance of on-site finance systems, the cloud technology revolutionised business people’s strategies and resourcing models.

Scaling organisations in the mid-market space were then able to re-think the shape of their finance teams with personnel able to work from every corner of the world, and design business processes that brought agility to working and business practices, such as hybrid working. It allowed decision makers to create resource models that could be kept flexible, allowing for test and learn approaches as the business scales and its needs evolve in peaks and troughs.

“Efficiency has been tremendously improved. We can utilize the resources internally and with the accountant in a completely different way than before. Our controllers are free to work with business support and avoid administrative work. If we double the turnover, we do not necessarily need to hire more people.” comments Eline Flacke, CFO of Corporater, a global software house, in relation to their decision to outsource their accounts.

Cloud innovation also enabled easier access to information, real-time data. By opening up physical boundaries, it’s helped organisations as well as their business partners, such as accountancy firms, have one single view of the current financial insights – removing outdated reporting and helping to focus on crucial business decisions for the present and the future.

“When all financial data is available in the same system, we achieve transparency in all areas […] In Xledger, with one keystroke we have a full overview, with real-time data: the latest updated data level and down to each project are always available”, continues Eline.

A partnership based on a common vision

DG Finco is the outsourced arm of top 100 accountancy firm Milsted Langdon. This outsourced ‘in-house’ finance team is led by a team of directors and staff with a combined total of over 35 years experience. DG Finco’s aim is to take away the mundanity of recruiting, managing and growing finance teams, allowing clients to focus on the doing of their business.

Milsted Langdon, originally established over 30 years ago, is one of the leading independent firms of Chartered Accountants and Business Advisors in the South-West. Milsted Langdon was the only firm in the country to ever win Firm of the Year in the Practice Excellence Awards for three consecutive years. Most recently, the organisation has been shortlisted in the Accountancy Excellence Awards 2022 for Large Firm of the Year.

Xledger UK supports financial teams in mid-market organisations with a leading cloud-based software solution that brings automation, scalability and insights into their processes, enabling them to make critical decisions that make a difference for their business.

Together, this partnership is providing businesses with a dedicated finance team and cloud-based finance software that can enable decision makers to drive forward business growth.

If you have any questions surrounding this article, please feel free to contact Phil Chalmers on phil.chalmers@xledger.co.uk or 07425 638718.