Complex company structures are a headache for finance departments. From an operational perspective, we want to gain efficiency by creating synergy, removing silos, and eliminating duplication of effort. But, from a finance system perspective, maintaining separate, discreet databases for each statutory entity does little to facilitate this effort.

From a finance system perspective, maintaining separate, discreet databases for each statutory entity does little to facilitate this effort. The best way to overcome these issues is to opt for a finance system that can achieve a live consolidation and this article will explain why.

Traditionally, finance departments of group entities face several common issues when consolidating:

Susceptibility to error: For many organisations, consolidation is completed manually in Excel. Reporting deadlines often create time constraints, making reports liable to last-minute adjustments and therefore susceptible to errors.

Lack of insight: Secondly, with manual consolidation, it is practical to download and consolidate each entity at an aggregate level. This limits the ability to drill down, analyse and understand underlying movements at a transactional level. Also, because it takes time to consolidate, this limits the frequency of reporting availability.

Duplication of effort: Then, there is the duplication of effort from maintaining separate databases. Day-to-day tasks such as approving invoices and processing transactions must be completed individually for each statutory entity, and the same suppliers, customer account codes and analysis fields need to be recorded separately in each database.

Light at the end of the tunnel

Thankfully, a modern finance system can solve these problems by producing a live consolidation, and the best way to achieve this is to look for a finance system with a technical structure that allows the entities to be built and maintained hierarchically.

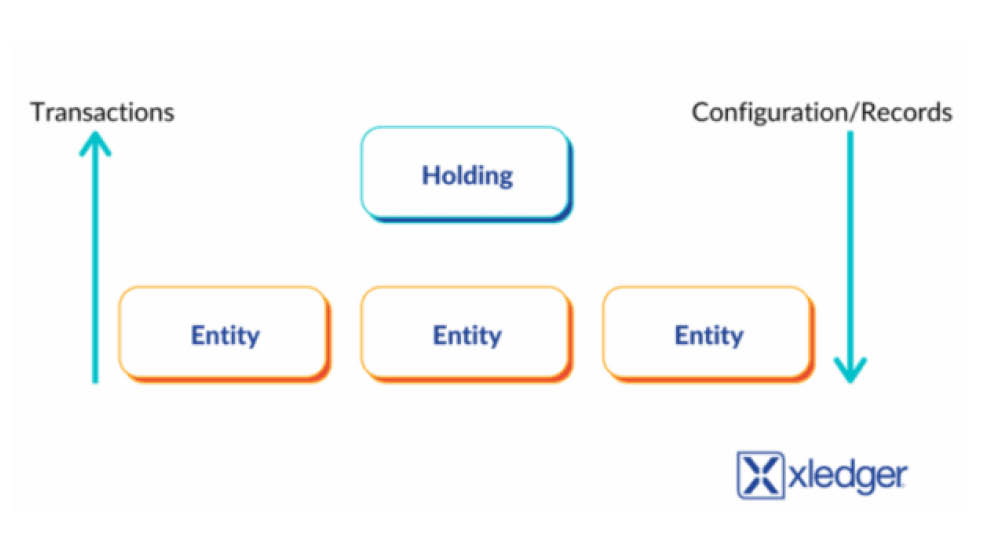

With hierarchical entity structures, a ‘holding’ company sits above the individual statutory entities in a group. When a transaction is posted in an individual entity, it also exists in the database of the ‘holding’ company.

Likewise, when a configuration or a record (such as a supplier or cost centre) is added in the holding company, they are also available in the entities below. Duplication of effort is, therefore, removed.

This structure provides the basis for an in-system, live consolidation which eliminates the need to create end-of-month Excel spreadsheets. Furthermore, instead of needing to go into each entity for analysis, you can drill down to the individual transactions and see the live data.

With hierarchical entity structures, while retaining the integrity of statutory reporting, you receive:

- Automated, real time consolidation, removing the requirement to manually post intercompany eliminations.

- The capacity to drill down from consolidation to individual transactions.

- Increased productivity by removing duplication of effort across entities.

- The power to approve invoices and payments across the entire group in one location.

- Scalability through efficient onboarding, as when new entities are added, common configuration and records are automatically inherited from the group.

- The ability to post journals across multiple entities with auto-balances and inter-company transactions.

A modern financial system with a hierarchical entity structure is undoubtedly a game-changer for multi-entity organisations and is the best way to overcome the issues commonly faced. Ultimately, by achieving a live consolidation, organisations improve accuracy and increase efficiency by removing silos and duplication of effort.

If you have any questions or would like to find out more about Xledger’s unique hierarchical entity structure, book your free demo today.

Get in touch

Speak to one of our dedicated team members for more information on how Xledger can support your business.

Contact person