The Energy sector relies heavily on group consolidation and real-time insights into farms, projects, and departments to understand individual and group-wide financials. We unpack how multi-entity energy groups can manage workflows to ensure this data is accurate and accessible.

Managing multiple projects or entities without the correct software is a complex task. In the Energy sector, organisations often include a parent company and numerous individual projects or farms, each operating as a single entity, only adding to the intricacy of multi-entity accounting.

However, when energy companies and energy finance software combine, accessing the right data morphs from a looming shadow to a ray of sunshine.

How does energy accounting software save energy companies time?

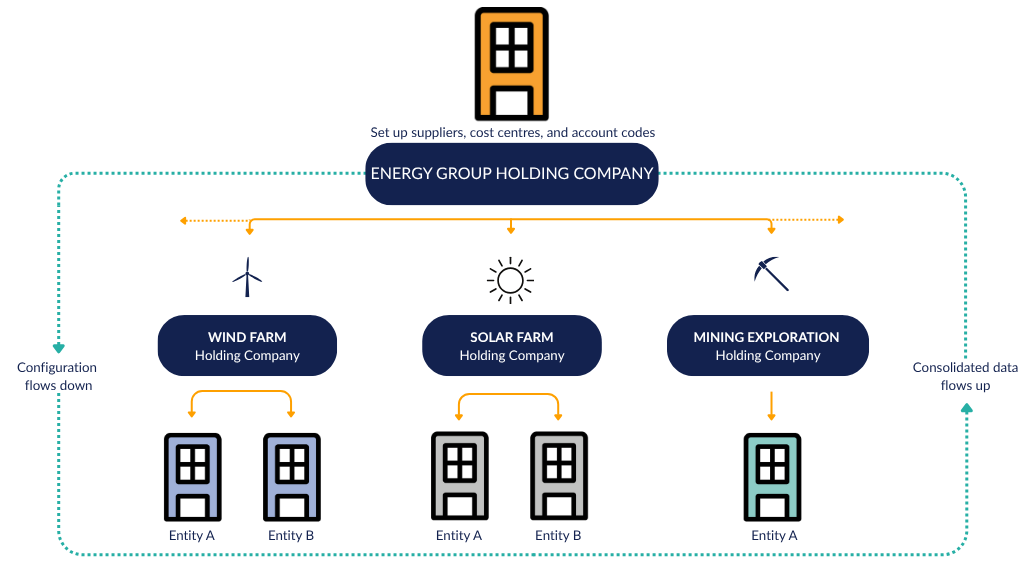

Energy accounting software saves time by streamlining the setup and maintenance of entities at the group level and eliminating task duplication to create efficient accounting workflows. Multi-farm companies can create rules at the group level, which then filter down to all entities beneath it.

Below, you’ll see a diagram that shows the movement of configuration and energy data in multi-entity accounting software in relation to energy companies.

Case study: Cornish Lithium

Like most energy companies, Cornish Lithium manages multiple business entities with simultaneous projects. The Trelavour lithium project operates in tandem with their renewable energy Geothermal Water extraction project, and the company needed an accounting solution that supported parallel projects.

With Xledger, Cornish Lithium can manage separate projects across multiple currencies easily. The organisation’s finance function can dive into the budgets and spending of separate entities while viewing the wider company’s performance.

“[Xledger] allows us to consolidate multiple entities in multiple currencies quickly and easily. […] The reporting functionality has been excellent. We can now report our month-end numbers in a matter of hours, where once it used to be days.”

Not only does Xledger’s structure benefit a company’s overall management of projects and farms, but it also provides a single version of the truth, eliminating error-prone figures. Armed with accurate data, real-time reports, and management dashboards, stakeholders can pitch to investors with complete confidence in their project management and financial records.

“We’re looking forward to working with Xledger as it integrates with a very bespoke engineering and project scheduling software we will need to execute [a large] construction infrastructure project by bringing that together with the financial reporting.”

Case study: Arise Group

With a complex structure of more than 25 companies, Arise required a multi-entity accounting solution that could cope with the entire value chain workflows. This ranged from exploration to permit management, financing and construction to wind turbine operations.

With dozens of parallel running projects, a robust project reporting module was a non-negotiable for the group. Xledger’s cloud-based ERP provides flexible and accessible performance monitoring for the group’s finance function, as well as automated intercompany postings to ensure all accounts remain in balance.

“The wind power projects are gathered in different legal entities, which means that the quick and efficient Group management in Xledger saves us a lot of time. […] All financial information is gathered at the group level with the possibility of drilling into individual companies.”

What benefits does Xledger offer?

Xledger’s hierarchical structure makes data management easy. With real-time, in-system consolidation, our finance solution simplifies group reporting requirements, streamlines intercompany transactions, and takes the hassle out of entity setup and maintenance.

Energy finance leaders may not realise the extent to which their current finance management system facilitates task duplication. With Xledger, you can:

- Set up a supplier, cost centres, and configurations once and access the same information across all entities.

- Automate billing and postings to the journal lines for both entities in the same journal to ensure balanced intercompany accounts.

- Ensure compliance across all entities, and streamline the creation of auditing packages.

- Trust a single source of the truth with consolidated financial statements across the whole organisation’s financial position.

The sheer breadth and complexity of the energy sector have inspired a mistaken belief that only bespoke, aggressively customised, and expensive energy management software could meet industry needs.

Xledger’s user-friendly interface caters to mid-market companies with configurable, highly automated accounting software. Xledger reduces manual tasks, consolidates data to inform decision-making, and ensures complete cohesion across all entities’ financial management.

Energy finance leaders gain complete cost control, and, with oversight of the group’s financial position, stakeholders have a better understanding of energy waste and energy usage.

Take on the future with Xledger

Xledger delivers the market’s most automated and unified finance solution, providing powerful multi-entity accounting features that support complex group structures.

We empower energy companies with powerful core accounting, project accounting, asset management, and consolidated reporting capabilities, among others. Built for the true, multi-tenant cloud, Xledger offers unparalleled scalability, enabling every customer to grow without restriction.

Book a free demo today to discuss how Xledger can provide your group with the ultimate financial unity, flexibility, and efficiency.

Get in touch

Speak to one of our dedicated team members for more information on how Xledger can support your business.

Contact person

Accounting Software for Energy Organisations

Many energy companies face the complexity of managing multiple entities and Special Purpose Vehicles (SPVs) through inadequate or outdated finance systems.

Xledger’s true-cloud finance solution is purpose-built for multi-entity businesses, reducing inefficiencies to provide finance teams with real-time financial insight and control.