Real-time data is vital to monitoring schemes and gaining funding for new developments, but how can housing associations access it? We explore the obstacles to real-time reporting, why they occur, and how robust reporting tools can help the Housing sector overcome them.

Housing associations are often tight on budget, time, and resources, so investing in expensive, customisable software for reporting is not a viable option. The alternative is a configurable system tailored to suit each housing association’s needs.

With a configurable system, housing associations can outline a structure of inherited rules that work for their organisation. These rules can apply to everything, from invoicing and billing to reporting and forecasting, ensuring housing associations get optimal use out of their investment.

Are you a housing association that struggles to access real-time reporting data for drill-down analysis? Get in touch to discuss how Xledger’s configurable reporting tools can help your budget holders achieve self-sufficient cost oversight.

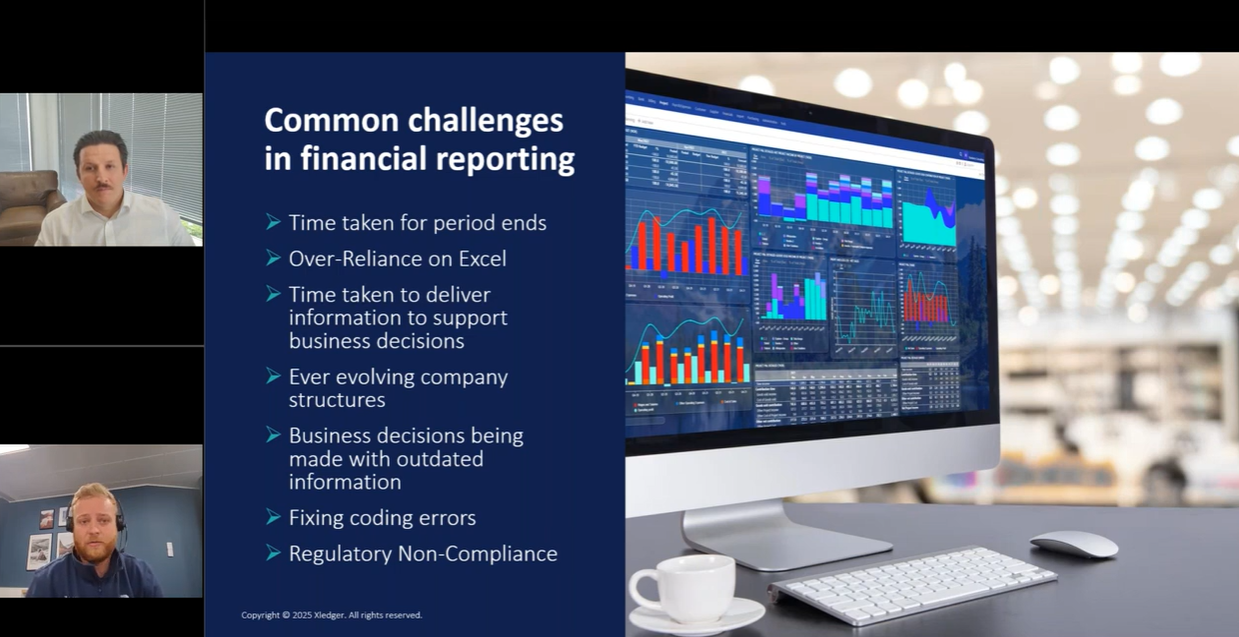

Challenges in financial reporting for housing associations & why they arise:

1. Lengthy month-end caused by manual processes

A lengthy month-end is usually caused by a lack of automation, where a stretched finance team has to manually close down all ledgers and ensure all numbers are accurate for management accounts. Human error increases as a result, delaying reports and causing inaccuracies in the accounts. Without a modern, integrated, and automated accounting software, month-end can become a dreaded nightmare. This nightmare can take up to two weeks to re-live, every month, causing finance teams to lose half a working year to inefficient closing workflow.

2. Poor quality data due to an over-reliance on Excel

Housing associations know the drill: an individual builds a complex reporting sheet that they can flex and fix whenever necessary. When that person leaves the company and the formulas break, no one can fix it. This leaves masses of data siloed in a spreadsheet, with no hope of migration.

Exporting data from multiple sources is not only time-consuming but also a barrier to accurate numbers that support decision-making. When stakeholders face these common risks — a lack of access to real-time data or data siloed in broken spreadsheets — the business suffers. Consequently, new developments that aren’t supported by real-time data can fail before completion as investors pull funding from the scheme.

3. Inflexible legacy systems hinder restructures

Housing associations are no strangers to ever-evolving company structures and have seen numerous mergers and acquisitions in the past decade. Unfortunately, legacy or on-premise systems cannot support these internal movements, leading to unretrievable data and reporting challenges.

4. Lack of support as on-premises systems are sunsetted

The Housing sector has seen many housing management software providers sunset their legacy systems, leaving organisations with old systems and no support if bugs appear or updates are needed.

Subsequently, housing associations are left with software that isn’t updated for Making Tax Digital (MTD), Environmental Social Governance (ESG), or SORP, for example. Not only does this silo data kept in the sunsetted system, it also means that users with read-only status are overloaded with data questions that steal time from their day-to-day tasks.

Unlocking In-Depth Financial Analysis for Housing Associations

Watch the full webinar to learn how housing associations can gain deeper financial insights through real-time reporting tools.

How can housing associations access real-time data?

Real-time data is the key to understanding where your organisation should increase, re-allocate, and reduce spending. Here are three technical tips to help housing association finance leaders understand which software features unlock real-time insights.

Aid value-adding analysis with automated reporting

Automation is always the most efficient option, and automated reporting software is no different. For housing associations, automated reporting removes pressure from finance teams that spend hours sifting through spreadsheets or invoices.

Instead, pre-configured buttons provide all appropriate users with access to the data they need, tools to visualise it in digestible ways, and the confidence to provide finance leaders with value-adding feedback as a result.

Leverage flexible and hierarchical reporting structures

Flexible and hierarchical reporting structures help a multitude of people to leverage the reporting tools in multiple ways. This is key to encouraging user buy-in and accountability, particularly where budget holders can oversee costs through graphs, tables, or other visual reporting aids on their self-serve, intuitive dashboards.

Suppose budget holders can clearly see the actual performance data, which purchase orders are still outstanding or invoices are due for payment. In that case, they can understand how much budget is left to inform decisions. Similarly, accountants can leverage self-serve dashboards, click presentation mode, and display real-time figures to board members with assurance.

Improve accuracy with multi-dimensional reporting

Moving from an on-premise system to cloud-based finance software creates opportunities for finance to report in different dimensions, such as a flexible chart of accounts (COA) that is built into the structure.

The COA then breaks down into further dimensions, including cost centre, project funds, sub-ledgers, or custom dimensions. With a cloud-based ERP, housing associations can make mandatory fields when posting. An example rule could be:

“You can’t post income and expenditure without having a cost centre fund code attached.”

Mandatory rules remove the month-end panic and ensure that all numbers and fields are completed. Similarly, Housing associations benefit from the ability to post an entry as a transaction immediately. This immediacy improves accuracy and oversight when tracking transactions. Additionally, the immediacy of entry eliminates mass data imports at month-end, again reducing time-consuming and error-prone tasks and replacing them with value-adding analysis.

Unlock insights in real-time

Finance functions in housing associations often operate at high capacity, with manual tasks and spreadsheet reporting eating up precious time that could be used to analyse data and drill down into various dimensions.

With flexible hierarchical reporting, multiple dimensions, and automation, busy finance functions can turn from overworked to value-adding in just a few clicks.

If you’re a finance leader needing to unlock real-time insights for your housing association, book your free demo today. Our accountancy-trained consultants can help your organisation unlock real-time insights with flexible, automated reporting tools.

Get in touch

Speak to one of our dedicated team members for more information on how Xledger can support your business.

Contact person