Accounts Payable Automation

Master your accounting cycle by automating your accounts payable with Xledger's powerful automation—guaranteed to give you and your team back their lives.

Best-In-Class OCR Functionality

Automate Your Entire AP Workflow

Clear Insight into Cash Flow

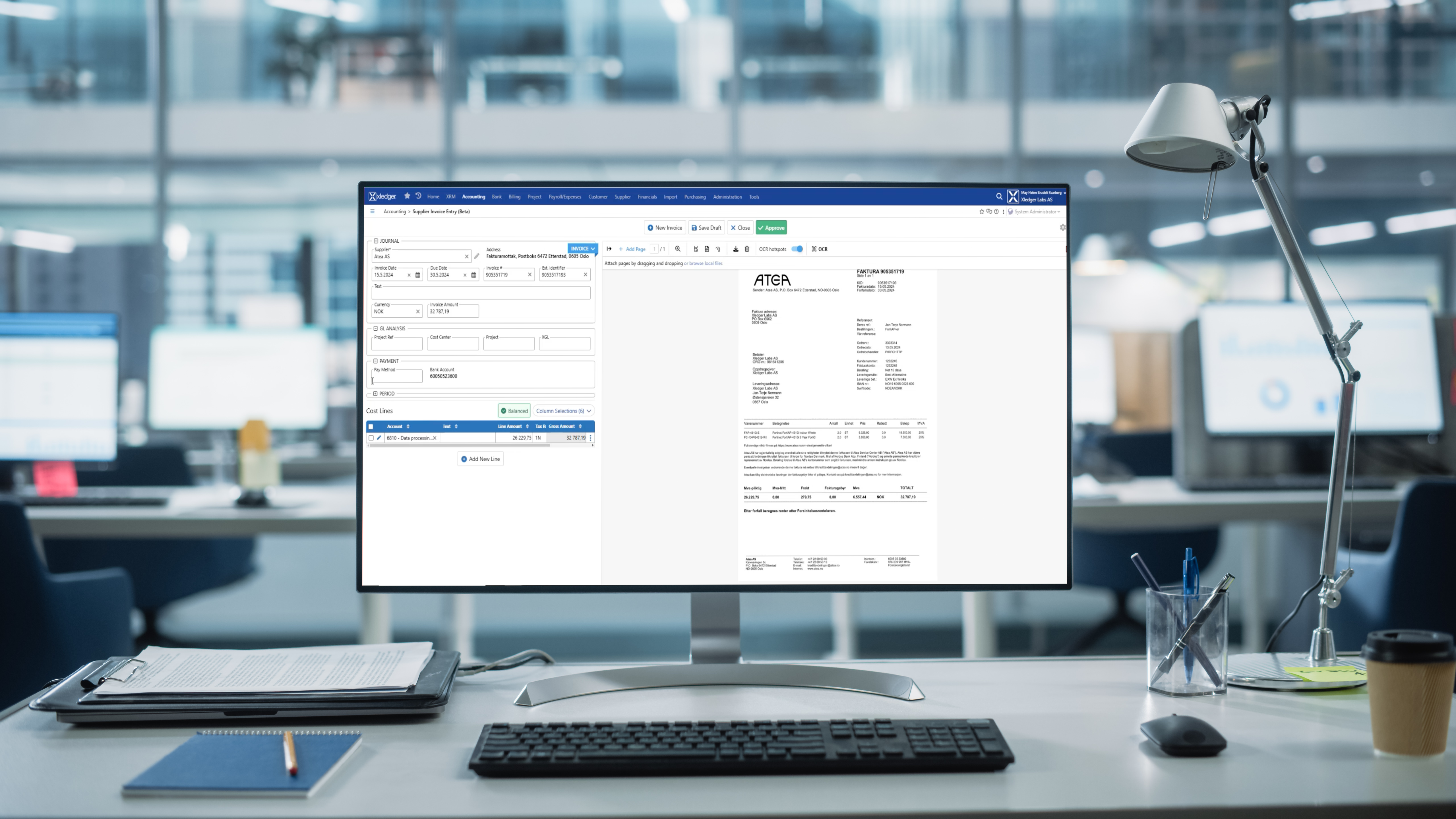

Best-In-Class OCR Functionality

Stop wasting time on manual data entry and use Xledgers’ 99% accurate proprietary OCR functionality to save time on your AP processes. The best part? It has machine learning—no more fighting with outdated technology and Frankenstein solutions.

Automate Your Entire AP Workflow

Set up automatic AP workflows from posting to approvals configured to your business needs. No more worrying about paying invoices, getting approvals from the right people, and say goodbye to the paper trail. Keep a record with a GAAP-compliant audit trail within Xledger.

Clear Insight into Cash Flow

Instantly gain insight into your business’s cash flow with our robust dashboards and reporting features when payments are processed. Have peace of mind and clarity to make the decisions your business needs for success.